Financial technology, or FinTech, is transforming the way we interact with money and financial services. FinTech startups are disrupting traditional banking and finance with innovative solutions that offer convenience, efficiency, and accessibility. In this article, we’ll explore the rise of FinTech, its impact on the financial industry, key trends, and the challenges and opportunities it presents.

The Emergence of FinTech

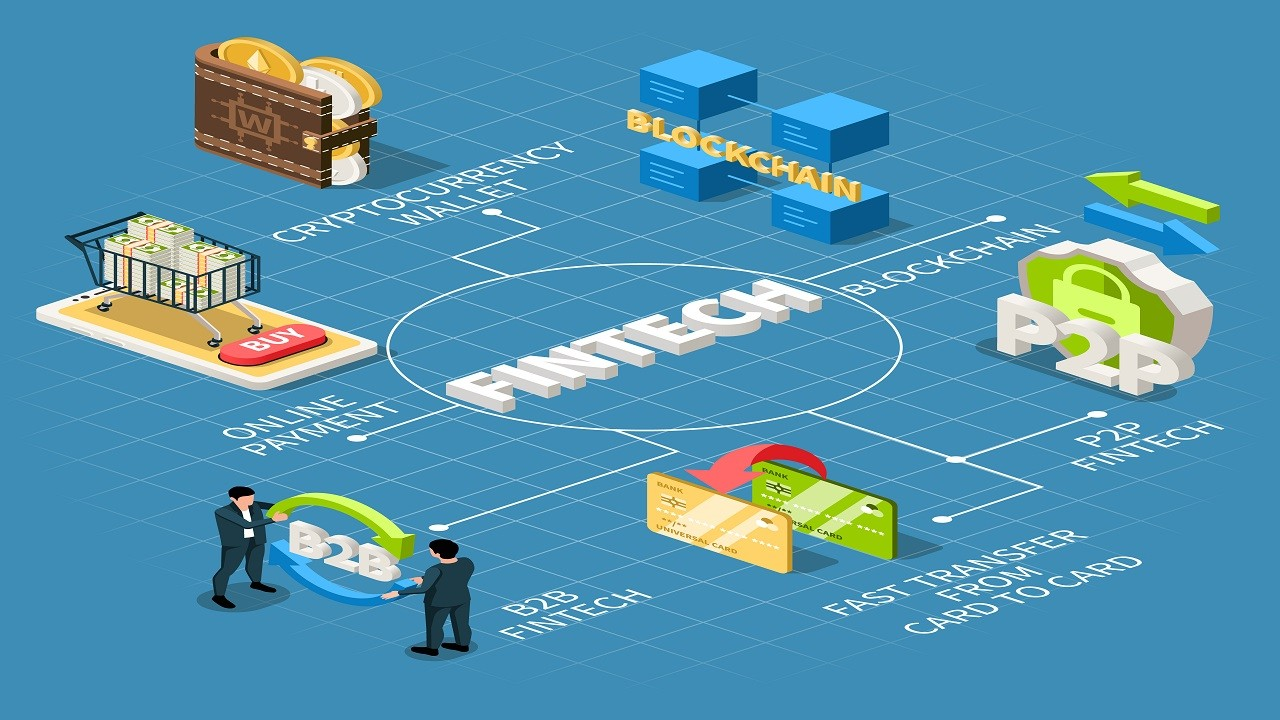

FinTech is the result of the marriage between finance and technology. It encompasses a wide range of financial services and products that leverage technology to make transactions and financial activities more efficient and accessible. Here’s how FinTech has emerged as a force in the financial industry:

- Digital Payments: Payment processors and digital wallets have simplified transactions, making it easier for consumers and businesses to send and receive money.

- Peer-to-Peer Lending: Platforms like LendingClub and Prosper connect borrowers with individual investors, bypassing traditional banks.

- Crowdfunding: Crowdfunding platforms enable individuals and businesses to raise capital from a large number of people.

- Robo-Advisors: Automated investment platforms use algorithms to manage portfolios, offering cost-effective investment solutions.

- Blockchain and Cryptocurrencies: Technologies like blockchain underpin cryptocurrencies like Bitcoin and Ethereum, providing decentralized and secure alternatives to traditional currencies.

Impact on the Financial Industry

FinTech startups have had a significant impact on the financial industry:

- Increased Competition: Traditional banks and financial institutions face competition from FinTech companies, leading to improved services and lower fees.

- Enhanced User Experience: FinTech solutions prioritize user experience, offering user-friendly interfaces and streamlined processes.

- Accessibility: FinTech has made financial services more accessible to underserved populations, including the unbanked and underbanked.

- Innovation: The industry is experiencing rapid innovation, with new products and services continuously entering the market.

- Cost Savings: FinTech reduces operational costs, making financial services more affordable for both businesses and consumers.

Key Trends in FinTech

- Open Banking: Open banking initiatives encourage banks to share customer data with FinTech companies, fostering innovation and improving service offerings.

- Digital Banking: Digital-only banks, or neobanks, are gaining popularity for their mobile-first and customer-centric approach.

- RegTech: Regulatory technology, or RegTech, helps financial institutions comply with complex regulations more efficiently.

- InsurTech: Insurance technology startups are reshaping the insurance industry, offering more customized and tech-driven coverage.

- Embedded Finance: Financial services are becoming integrated into other industries, such as e-commerce and transportation.

Challenges and Opportunities

FinTech faces both challenges and opportunities:

Challenges:

- Regulatory Compliance: Compliance with ever-evolving financial regulations is a significant challenge for FinTech companies.

- Cybersecurity: The digital nature of FinTech exposes it to cyber threats and data breaches.

- Consumer Trust: Gaining and maintaining consumer trust is crucial, especially with new and disruptive financial services.

- Monopoly Concerns: As FinTech companies grow, concerns about monopolistic behavior and market concentration may arise.

Opportunities:

- Financial Inclusion: FinTech can provide financial services to underserved populations, promoting financial inclusion.

- Innovation: FinTech companies can continue to innovate, offering solutions that improve financial services.

- Cost Savings: The use of technology can lead to cost savings and more affordable services.

- Customization: FinTech can provide more tailored financial products and services to individuals and businesses.

In Conclusion

The rise of FinTech startups is reshaping the financial industry, offering convenience, efficiency, and accessibility. While challenges exist, the opportunities for financial inclusion, innovation, and cost savings are significant. The continued growth of the FinTech sector will likely bring further disruption and transformation to traditional banking and financial services.