Introduction

The digital revolution is reshaping the financial landscape, with online trading platforms playing a pivotal role in this transformation. The commodity trading account opening online and online share trading account have become central to this boom, significantly influencing the Indian stock market. This blog explores the impact of these digital tools on India’s stock market in 2024, the current scenario, and what the future holds for both domestic and global markets.

The Rise of Digital Trading Platforms

In recent years, the surge in digital trading platforms has revolutionized how investors engage with the stock market. This shift has been marked by several key developments:

- Ease of Access: Online trading accounts, both for commodities and shares, have made it easier for investors to enter the market. The commodity trading account opening online process is streamlined, eliminating the need for physical paperwork and lengthy procedures. Similarly, online share trading account setup has become more user-friendly, allowing investors to start trading with just a few clicks.

- Advanced Features: Modern trading platforms offer a range of advanced features, including real-time data, automated trading, and sophisticated analytical tools. These features enhance decision-making and provide investors with a competitive edge.

- Increased Participation: The accessibility and convenience of online trading have led to a significant increase in retail investor participation. This rise is evident in the growing number of trading accounts opened each year and the higher trading volumes observed across markets.

The Indian Stock Market Scenario in 2024

As of 2024, the Indian stock market is experiencing notable changes driven by the digital trading boom:

- Surge in Trading Activity: There has been a marked increase in trading activity, fueled by the ease of opening online accounts and the proliferation of digital platforms. This trend is reflected in higher trading volumes and increased market liquidity.

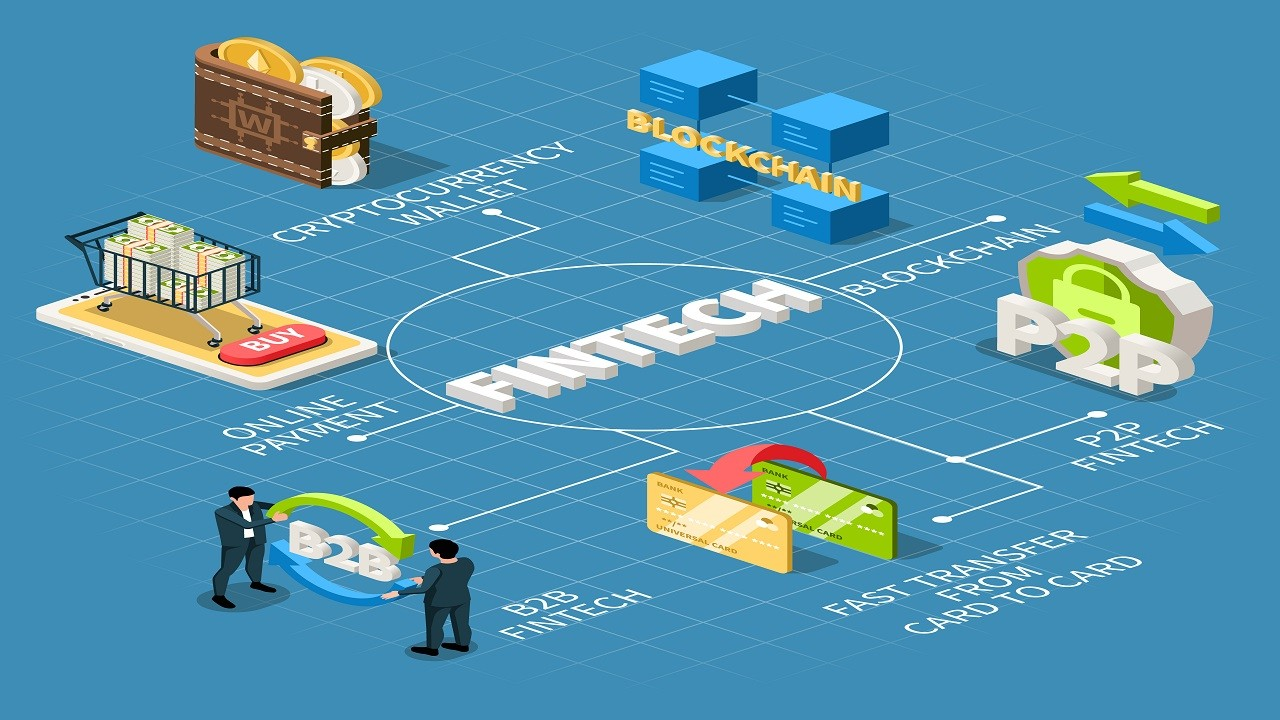

- Technological Advancements: The integration of technologies such as artificial intelligence (AI) and blockchain is transforming trading practices. AI-driven analytics are providing investors with predictive insights, while blockchain technology is enhancing transaction security and transparency.

- Regulatory Developments: The Securities and Exchange Board of India (SEBI) has introduced several new regulations aimed at improving market transparency and protecting investors. These include stricter guidelines on margin trading and enhanced disclosure requirements.

- Market Volatility: The rapid rise in online trading has contributed to increased market volatility. The influx of new investors and the rapid execution of trades can lead to more pronounced price movements, impacting market stability.

Future Prospects and Global Impact

Looking ahead, the digital trading boom is expected to continue shaping the market in several ways:

- Enhanced Technological Integration: Future trading platforms will likely incorporate even more advanced technologies. Blockchain will play a greater role in securing transactions, while AI will offer deeper market insights and automation features.

- Global Trading Trends: The global market is also experiencing a digital transformation, with similar trends observed in other major financial centers. The interplay between domestic and international developments will influence investment strategies and market dynamics.

- Increased Financial Inclusion: The ongoing efforts to improve financial literacy and access to trading platforms will continue to drive growth in retail investing. As more individuals gain access to these tools, the market will become more inclusive and diverse.

- Evolving Market Structures: Both Indian and global markets will adapt to technological advancements and changing investor preferences. New market structures and trading practices will emerge, influencing how investments are managed and traded.

The Difference Between Trading Account and Demat Account

To fully understand the impact of digital trading, it’s essential to distinguish between a trading account and a Demat account:

- Trading Account: This account is used to execute buy and sell orders for various securities. It provides access to stock exchanges and facilitates the trading process. Online trading accounts offer real-time data, order execution, and market access.

- Demat Account: A Demat account holds securities in electronic form, eliminating the need for physical certificates. It ensures secure storage and facilitates the transfer of securities between accounts. While a trading account is used for executing trades, a Demat account is essential for holding and managing the securities acquired through those trades.

Conclusion

As the market continues to evolve, understanding the difference between trading account and Demat account is crucial for investors looking to navigate these changes effectively. By leveraging the latest technological advancements and staying informed about regulatory developments, you can make strategic decisions that align with the dynamic landscape of both the Indian and global stock markets. The future of trading is digital, and embracing these tools will be key to achieving long-term investment success.